Mysten Labs to Buy Back Equity, Token Warrants From FTX Bankruptcy Estate for $96M

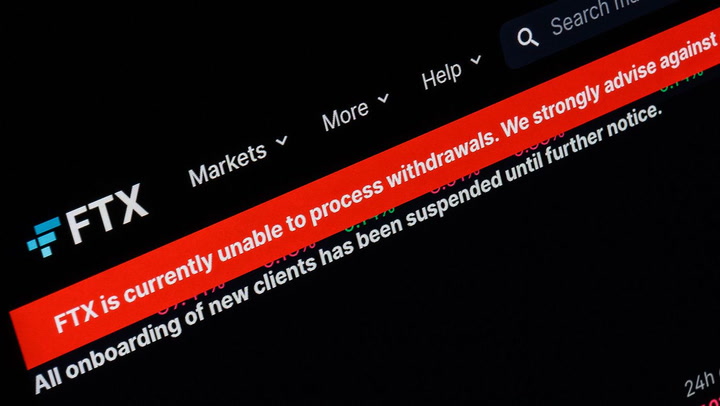

FTX Ventures invested $101 million in Mysten Labs just months before Sam Bankman-Fried’s empire collapsed. Now, Mysten is buying back the stake (and sui token warrants) for $96 million through bankruptcy court.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/U4Z4LS3IHBGVNNZOGS2POK2ULI.jpg)

Mysten Labs, the team behind the Sui blockchain, entered into an agreement on Wednesday with the FTX bankruptcy estate to purchase FTX’s equity investment in Mysten Labs and sui token warrants for $96.3 million in cash, according to court filings.

The buyback agreement marks the ongoing efforts of FTX CEO John J. Ray III to maximize what creditors recover from Sam Bankman-Fried’s collapsed crypto exchange, a process that includes the liquidation of several crown jewels in the FTX Ventures portfolio.

Mysten Labs, which has yet to release its highly anticipated SUI token, offered to repurchase the assets in an offer letter to the FTX estate on March 16. According to court filings, the FTX bankruptcy estate retained investment bank Perella Weinberg Partners (PWP) to solicit interest from other potential buyers before ultimately entering into the deal with Mysten.

In August, FTX Ventures led Mysten Labs’ high-profile $2 billion Series B fundraise, just months before FTX filed for bankruptcy in November. The firm invested $101 million in the round, receiving about 570,000 shares of preferred equity in Mysten Labs and warrants to purchase up to about 890,000,000 SUI tokens, according to court filings. FTX entities paid about $101 million for the equity and an additional $1 million for the token warrants.

“After thoroughly evaluating alternatives with the assistance of PWP, the Debtors determined that it was in the best interest of their estates and their constituents to proceed with [Mysten Labs, Inc.] and work toward executing a mutually agreeable transaction, with the expectation that the Debtors will continue marketing the Interests and confirming that no higher and better offer exists over the course of the coming weeks,” said the filing.

It appears the FTX estate can continue to “solicit higher or better offers from any third party” up until a sale date is finalized by the court.

A spokesperson for Mysten Labs did not immediately respond to a request for comment.

Mysten Labs has completed the repurchase of its equity and warrants for $96 million, according to a press release issued on April 14.

Updated (April 14, 2023 17:55 UTC): Added that Mysten Labs has completed this repurchase.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/8bd01a52-3fcd-46f6-b1ee-3bedeee98f65.png)