LedgerX to Make $175M Available for FTX Bankruptcy Proceedings: Bloomberg

The money could be transferred as early as Wednesday.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JHRRCWFAHFFJLGFBZ56B6GJLNM.jpg)

LedgerX to reportedly make $175M available for FTX bankruptcy proceedings. (Shutterstock)

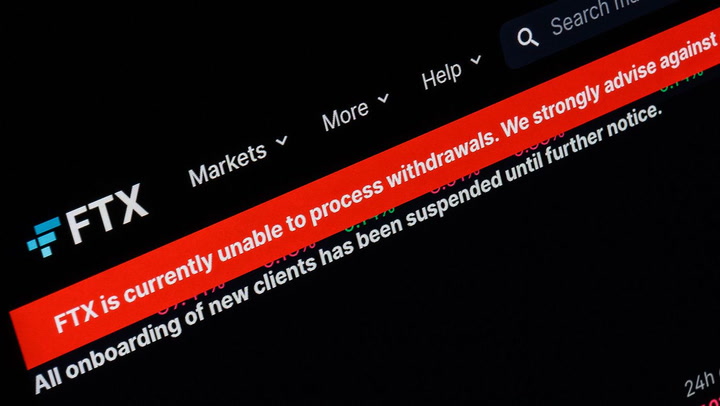

LedgerX, a subsidiary of bankrupt crypto exchange FTX, is preparing to put up $175 million toward its parent company's bankruptcy proceedings, according to a Bloomberg report, which cited people familiar with the matter.

The money could be transferred as early as Wednesday.

The funds will come from a $250 million pot LedgerX was planning to use in a regulatory bid to get approval to settle crypto derivatives without the use of intermediaries.

The contribution from LedgerX would provide a crumb of comfort for FTX's more than one million creditors. FTX's top 50 creditors are collectively owed about $3.1 billion, according to court documents from the bankruptcy filing.

LedgerX, which was acquired by FTX's U.S. wing in 2021, is one of the only entities under the FTX umbrella to remain solvent. The parent firm and scores of its subsidiaries filed for bankruptcy this month.

Neither LedgerX nor FTX immediately responded to requests for comment.

Read more: BlockFi Joins the Bankruptcy Parade

CORRECTION (Nov. 30 18:51 UTC): A previous version of this story incorrectly stated that FTX's more than one million creditors were collectively owed $3.1 billion. That $3.1 billion is actually owed to FTX's top 50 creditors.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/008ae87f-5c6e-412b-816b-ded600ac5054.png)